new mexico gross receipts tax changes

New Mexico Register. We urge you to give it a try.

New Mexico S Capital Gains Deduction A Capital Loss For New Mexicans New Mexico Voices For Children

Ad Accurate withholding repotting to federal state and local agencies for all transactions.

. Several changes to the New Mexico Tax. On March 9 2020 New Mexico Gov. New Mexico is an outlier in the imposition of its gross receipts tax and broad inclusion of sales of services which creates unique complexities in the administration of this.

On August 9 2022 the New Mexico Taxation and Revenue Department published proposed regulations addressing the gross receipts tax New Mexicos. Automate manual processes and eliminate human error with Sovos tax wihholding solutions. The governors initiative will comprise a statewide 025 percent reduction in the gross receipts tax rate lowering the statewide rate to 4875 percent.

Effective July 1 2021 New Mexico changed Gross Receipts Tax GRT regulations to destination sourcing which requires most businesses to calculate and report GRT based. Collection and distribution data of the gross receipts tax are also provided in the Monthly Local. Notably for corporate income tax purposes the state.

On April 4 2019 New Mexico Gov. Under the new rules most New Mexico-based businesses pay the Gross Receipts Tax rate in effect where t heir goods or the products of their services. Through HB 163 New Mexico will become the first state in many years to reduce its state-level sales tax rate which the state refers to as its gross receipts tax.

The change in sourcing rules will put New. Gross Receipts Tax Changes 1. As for payment E-pay is the quick and green way to.

This would be the first. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate. On August 9 2022 the New Mexico Taxation and Revenue Department published proposed regulations addressing the gross receipts tax New Mexicos version of a sales tax.

Ad Find out what excise tax applies to and how to manage compliance with Avalara. Changes Coming to Combined Reporting System. This means there will no longer be a difference in rates.

Incorrect Gross Receipts Tax rate published for Gallup. More information about gross receipts tax is available from the Department of Taxation and Revenue Gross Receipts Overview. Tax Credits Overview.

Mary Van Leuven JD LLM. Tax Changes Start July 1 Posted on June 21 2021 by Admin The New Mexico Taxation and Revenue Department TRD and the New Mexico Economic Development. Gross Receipts Tax Changes.

Gross Receipts by Geographic Area and 6-digit NAICS Code. On April 4 New Mexico enacted significant corporate income and gross receiptscompensating tax changes. On August 9 2022 the New Mexico Taxation and Revenue Department published proposed regulations addressing the gross receipts tax New Mexicos version of a sales tax.

New Mexico taxpayers in disaster areas gain more time to file taxes. Under the new rules most New Mexico-based businesses pay the Gross Receipts Tax rate in effect where their goods or the products of their services are delivered. Filing online is fast efficient easy and user friendly.

1 Effective July 1 2021 the. Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things. Select the GROSS RECEIPTS TAX RATES link for additional tax rate information and schedules.

The gross receipts tax rate varies throughout the state from 5 to 9 and frequently changes. On August 9 2022 the New Mexico Taxation and Revenue Department published proposed regulations addressing the gross receipts tax New Mexicos version of a sales tax. Hearing Thursday on new Gross Receipts Tax regulations.

1 day agoThursday August 11 2022. Effective July 1 2021 local option compensation tax is now imposed at the same rate as local option gross receipts tax. Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico gross receipts tax.

Learn about excise tax and how Avalara can help you manage it across multiple states.

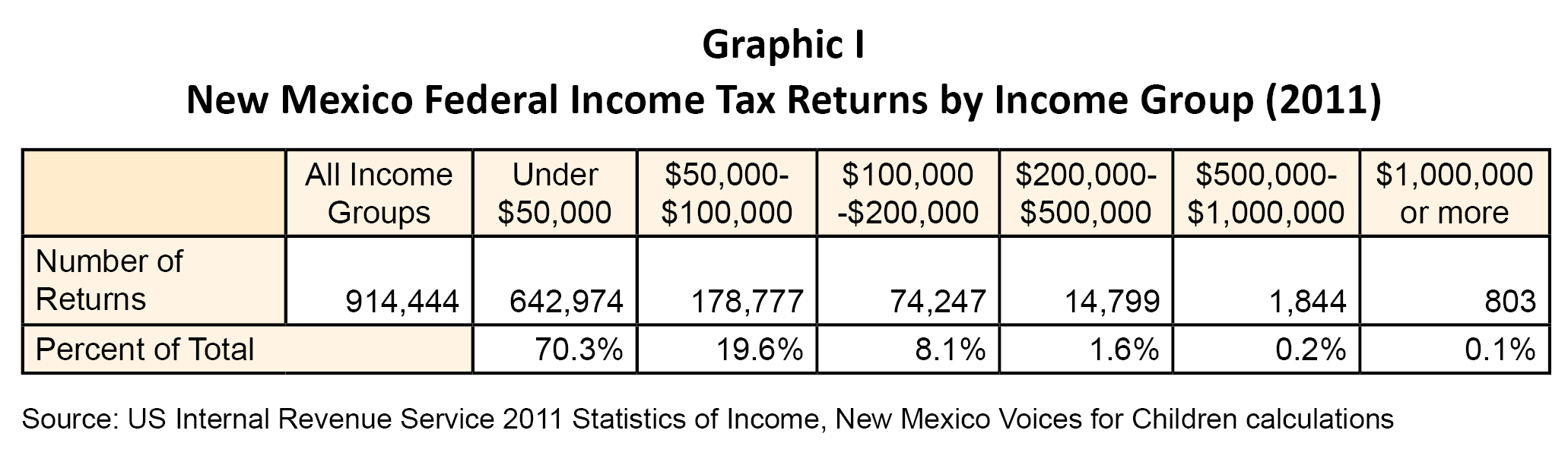

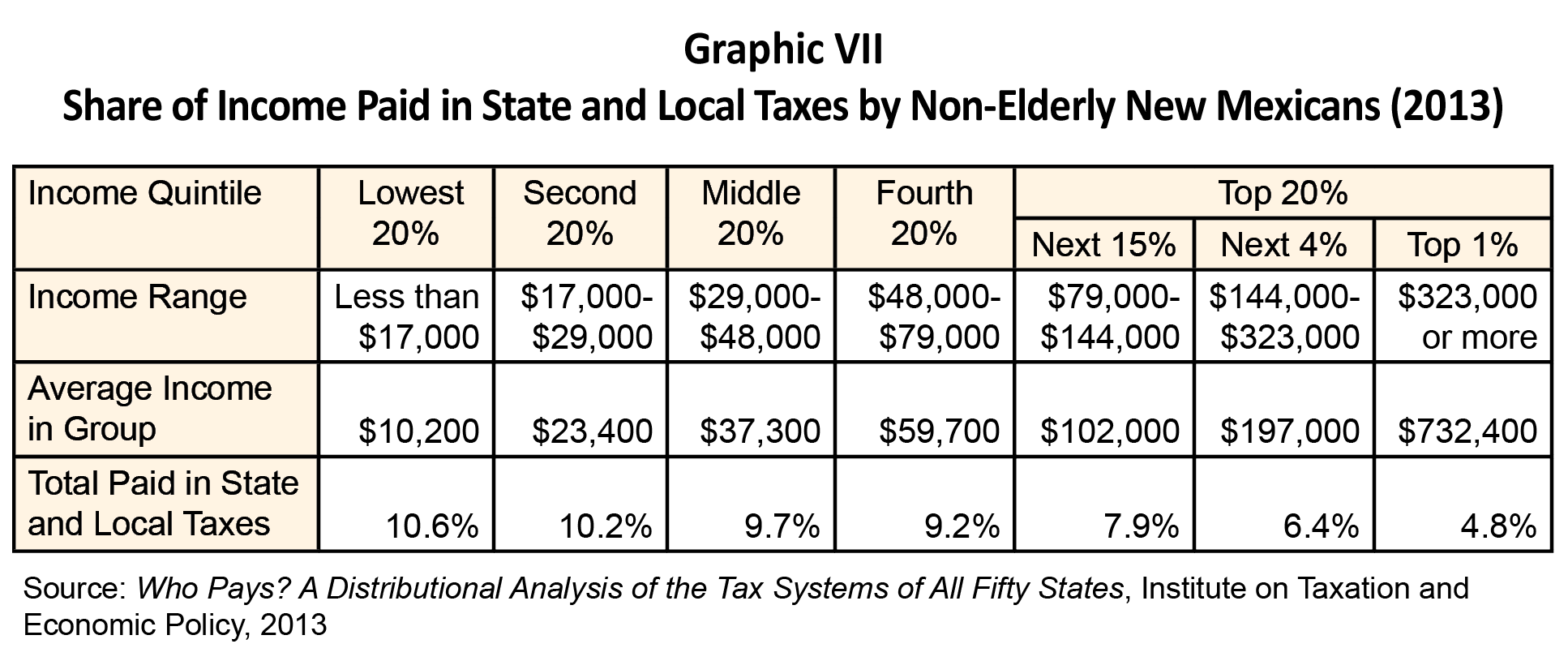

A Guide To New Mexico S Tax System New Mexico Voices For Children

Gross Receipts Location Code And Tax Rate Map Governments

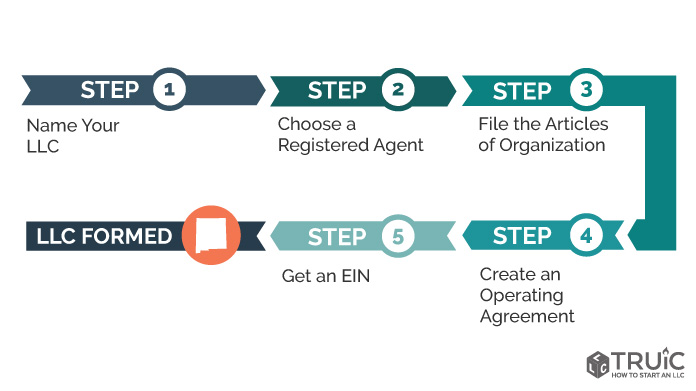

New Mexico Llc How To Start An Llc In New Mexico Truic

How To File And Pay Sales Tax In New Mexico Taxvalet

How To File And Pay Sales Tax In New Mexico Taxvalet

New Mexico State Economic Profile Rich States Poor States

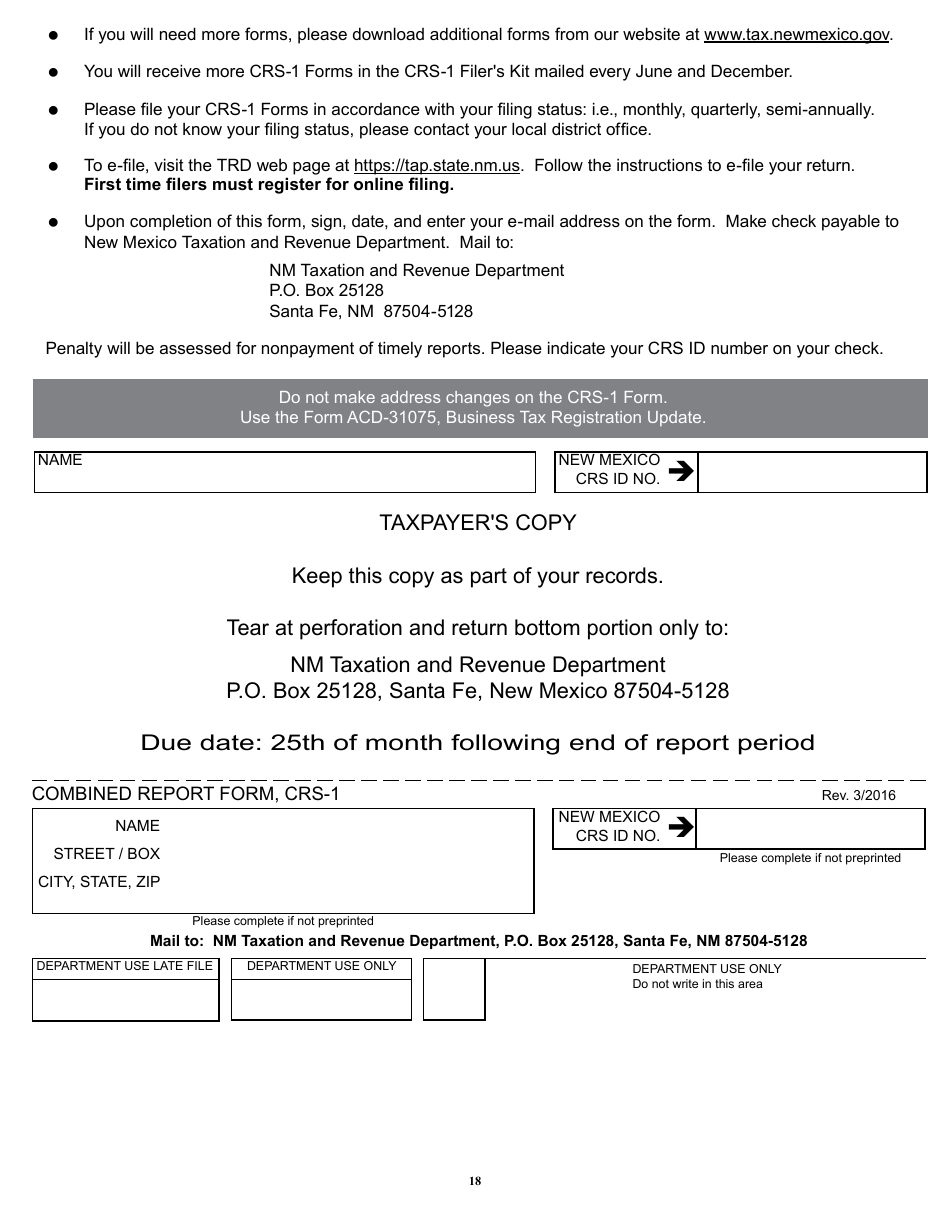

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report New Mexico Templateroller

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

How To File And Pay Sales Tax In New Mexico Taxvalet

Nm Gross Receipts Tax Location Codes Rates New Mexico Association Of Realtors

New Mexico S Capital Gains Deduction A Capital Loss For New Mexicans New Mexico Voices For Children

As Sales Tax Drops In Nm Hard Choices Await Albuquerque Journal

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children